![]()

Non-fungible tokens, or NFTs, have exploded into the mainstream consciousness in recent years. Is it the vanity of easy money or a possible way to stay an artist and make a profit? We will also explore current NFT use-cases and give a future outlook for NFTs.

What is NFT, and how can 3D art deal with it?

NFTs are simply certificates of ownership for digital assets. These unique digital things, like expensive pictures online, are a big deal now, but NFTs are entirely new. They started with people trying new things on the internet and artists selling their work in a new way. Imagine a unique digital signature for a piece of online artwork or a virtual collectible.

Most NFTs are 2D images or videos, but also 3D models or 3D images. These 3D NFTs can be anything from in-game avatars to virtual fashion items. They offer a new dimension for creative expression and ownership in the digital world. Since the rendering process of high-quality 3D art can require significant computational resources, a render farm comes in handy.

Could a 3D artist make money through NFTs?

The rise of NFTs has opened exciting opportunities for 3D artists to monetize their creations. Here's why:

- Unique and Valuable Assets: NFTs allow 3D artists to turn their work into unique, tradable digital assets. These can include anything from intricate sculptures to game character models.

- Global Marketplace: NFT platforms like OpenSea and Rarible connect artists with collectors worldwide, increasing their work's reach and potential value.

- New Revenue Streams: Beyond selling individual pieces, 3D artists can explore fractional ownership through NFTs, allowing collectors to co-own their creations. Royalties can also be programmed into the NFT, giving artists a percentage of future sales.

While the NFT market is still evolving, it offers a promising avenue for 3D artists to showcase their talent, build a following, and generate income. There is a nice and easy-to-follow free tutorial for beginners by Charlie Chang on how to make money with NFTs, which you can watch below:

Who created NFTs, and when did he start?

NFTs have a surprisingly young history. The first known NFT, "Quantum," was created in 2014. Kevin McCoy and Anil Dash are credited with creating "Quantum" and taking the initial step towards NFTs.

Notably, the concept of non-fungible digital assets was explored earlier with colored coins on the Bitcoin blockchain around 2012-2013. However, "Quantum" is considered the first true NFT due to its unique ownership capabilities on the Namecoin blockchain.

I know... All these terms for a beginner sound entirely "Chinese"! If you want to understand better what a blockchain is, take a look at this simplified video below:

The Genesis of NFTs: Colored Coins and the Dawn of Non-Fungibility (2012-2014).

The story of NFTs starts not with flashy jpegs but with colored coins. Introduced on the Bitcoin blockchain around 2012-2013, colored coins aimed to represent real-world assets like gold or loyalty points on a digital ledger. Though not truly NFTs (they weren't unique tokens), colored coins laid the groundwork for non-fungibility – the idea that digital assets could be differentiated and tracked on a blockchain. To get familiar with colored coins and what they really are, this is the best video I found:

Meanwhile, in the online art world, a new movement was brewing. Artists on platforms like Counterparty were experimenting with creating and selling digital art tied to the Bitcoin blockchain. This marked the birth of digital ownership for creative works, a crucial precursor to NFTs.

Birth of a Token: The "Quantum" Leap and the Rise of Ethereum (2014-2017).

In 2014, Kevin McCoy and Anil Dash took the next step, minting what many consider the first true NFT: "Quantum." This digital artwork, representing a physical piece, resided on the Namecoin blockchain, demonstrating the potential for unique digital ownership.

However, the true catalyst for NFTs came with the rise of Ethereum in 2015. Unlike Bitcoin, Ethereum offered a platform for developers to build smart contracts, self-executing code that could power decentralized applications (dApps). This opened a new frontier for NFTs, allowing for the creation of more complex and versatile tokens. Here is the story behind the first NFT:

CryptoKitties and CryptoPunks: The NFT Craze Begins (2017).

The year 2017 witnessed the birth of two iconic NFT projects that ignited the public's imagination: CryptoKitties and CryptoPunks. CryptoKitties, a game built on Ethereum, allowed players to breed and collect virtual cats, each represented by a unique NFT. The game's popularity clogged the Ethereum network at times, highlighting the potential and limitations of NFTs.

CryptoPunks, another Ethereum project, launched 10,000 algorithmically generated characters, each with distinct traits. These pixelated avatars became coveted collectibles initially available for free, with some selling for millions of dollars today. The success of CryptoPunks demonstrated the potential for NFTs as valuable digital assets beyond just gaming.

The Art Boom and the Mainstream Explosion (2018-2021).

The years that followed saw a surge in NFT art projects. Platforms like OpenSea and Rarible emerged, providing marketplaces for artists and collectors to buy, sell, and trade NFTs. Artists like Beeple leveraged these platforms to achieve mainstream recognition, with his work "Everydays: the First 5000 Days" selling for a record-breaking $69 million at Christie's auction house in 2021.

The NFT boom wasn't limited to art. Sports memorabilia, music rights, and even fashion brands started issuing NFTs, offering fans and collectors exclusive content and experiences. The possibilities seemed endless, with major corporations like Nike and Adidas jumping on the NFT bandwagon. But why did they do that?

The NFT Rollercoaster (2021-2024).

2021 was The Golden Age as NFTs exploded onto the scene fueled by a confluence of factors. Beeple's record-shattering $69 million grabbed headlines worldwide. Suddenly, everyone was talking about these digital tokens representing ownership of art, music, and even virtual cats (remember CryptoKitties). The art world embraced NFTs, with established artists like Damien Hirst and musicians like Kings of Leon releasing limited-edition NFT drops. Celebrities jumped on the bandwagon as well, with tweets and profile pictures featuring their Bored Ape Yacht Club avatars becoming a status symbol. NFT marketplaces saw record trading volumes, and stories of overnight millionaires fueled the frenzy. Platforms like NBA Top Shot offered digital trading cards featuring iconic basketball moments, attracting a new wave of collectors.

However, the party couldn't last forever. As 2022 dawned, the NFT market experienced a significant correction. The initial hype subsided, and some of the speculative frenzy cooled down. Critics highlighted issues like environmental concerns due to blockchain technology's energy consumption. Concerns about market manipulation and scams also emerged.

Despite the slowdown, 2022 wasn't a complete write-off for NFTs. The technology continued to evolve, with new use cases beyond artwork emerging. Nike and Adidas began experimenting with NFTs for virtual sneakers and merchandise.

The NFT landscape in 2023 and 2024 is one of cautious optimism. While the frenzy of 2021 may not return, the market seems to be finding its footing. There's a focus on building utility and real-world applications for NFTs. For example, musicians use NFTs to connect with fans and offer exclusive content. Companies are exploring NFTs for supply chain management and fractional ownership of real-world assets. Regulations are also being discussed, with governments and organizations trying to find ways to ensure the responsible development of the NFT ecosystem.

In this video below, with hundreds of thousands of views, I found a comment with about 5K likes saying: "NFTs just... weren't even good as a novelty. They were literally either stolen art or some procedurally-generated thing with a blockchain tag to it. Therein lay the problem: that blockchain wouldn't stop people from simply hitting "right click > save as." They had no substantial value, and I cannot think of any way for them to gain any. It was once again a bunch of tech bros who, desperate to innovate, created a solution that wasn't even in search of a problem because there was none in the first place."

The Future of NFTs: Challenges and Opportunities.

The NFT landscape is constantly evolving. Critics point to environmental concerns due to blockchain energy consumption, market volatility, and potential scams.

However, the core concept of NFT technology remains promising. Potential applications beyond collectibles are being explored – from revolutionizing supply chain management to enabling fractional ownership of real-world assets.

Predictions and Trends for NFTs.

NFTs are likely to move beyond just being digital bragging rights. We'll probably see a shift towards real-world applications taking center stage. Imagine using NFTs to track products through the supply chain, verify the authenticity of luxury goods, or even enable fractional real estate ownership—all with blockchain technology's security and transparency.

Conclusion.

The story of NFTs is far from over. We've witnessed a whirlwind journey, from the early days of colored coins and pixelated art to the record-breaking sales and the current focus on utility. While challenges remain, the potential of NFTs is undeniable. As the technology matures and regulations evolve, NFTs have the potential to reshape various industries and our relationship with digital ownership.

Summarizing the NFT Journey.

This deep dive explored the fascinating world of NFTs. We learned that NFTs are certificates of ownership for digital assets with the potential to extend to 3D creations. We discovered their surprisingly young history, beginning with colored coins and culminating in the rise of platforms like OpenSea and artists like Beeple. The NFT rollercoaster ride of 2021 was followed by a correction period, but the technology seems to be here to stay.

Final Thoughts on Pixels to Profits.

The initial question of whether NFTs are a fad or a sustainable path for artists has yet to be fully answered. While the "get rich quick" mentality surrounding early NFT sales may not be the norm, creators can showcase their work, connect with fans, and generate income through novel ownership models.

Nevertheless, true success will likely lie beyond the digital art world. The potential applications of NFTs for revolutionizing supply chains, verifying product authenticity, or fractionalizing real estate ownership hold immense promise.

Use Cases of NFTs.

While digital art and collectibles were the initial focus, the use cases for NFTs are expanding rapidly. Here are a few exciting possibilities:

- Supply Chain Management: Imagine tracking a product's journey from its origin to your doorstep using NFTs. This could enhance transparency and efficiency in various industries.

- Fractional Ownership: NFTs can divide ownership of expensive assets like real estate or artwork into smaller, more manageable pieces.

- Event Tickets: NFTs could revolutionize ticketing by offering secure, verifiable proof of ownership and eliminating the risk of counterfeiting.

- Gaming: In-game items and characters can be represented by NFTs, allowing players to own their digital assets and transfer them between games.

- The Metaverse: As the concept of a virtual world (the Metaverse) gains traction, NFTs will likely play a crucial role in establishing ownership and identity within this digital space.

What about NFTs and AI? Can they work together? What happens today?

Absolutely, NFTs and AI are a powerful combination that's shaking things up!

Here's how they work together:

- AI-Generated Art NFTs: AI algorithms can create unique artwork that can be minted as NFTs. This lets artists explore new creative avenues, and collectors own these one-of-a-kind pieces.

- AI-Driven NFT Markets: AI can analyze data to recommend NFTs to users, predict market trends, and even identify fraudulent activity. This can make the NFT buying and selling experience smoother and safer.

- Evolving NFTs: Imagine an NFT that changes over time. By embedding AI within NFTs, artists can create pieces that react to their environment or user input. This opens doors for dynamic and interactive digital art.

And this is just the beginning! The NFT and AI space is constantly evolving. Some current trends are below:

- Generative Art Success: Platforms like Art Blocks use AI to generate collections that have sold for millions, proving the value of AI-powered art.

- AI-Powered Marketplaces: Companies are developing AI-driven marketplaces that personalize recommendations and streamline transactions.

As you see, the possibilities seem endless, and innovation in the NFT space is ongoing. It will be exciting to see how this technology continues to evolve and shape the future of digital ownership.

Kind regards & keep rendering! 🧡

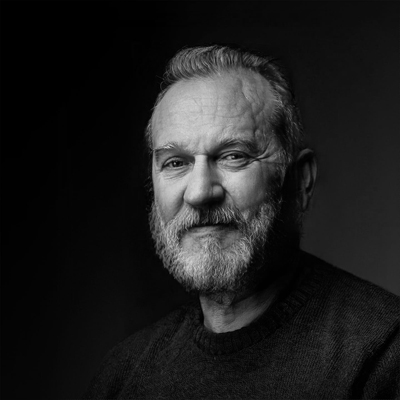

About the author

Vasilis Koutlis, the founder of VWArtclub, was born in Athens in 1979. After studying furniture design and decoration, he started dedicating himself to 3D art in 2002. In 2012, the idea of VWArtclub was born: an active 3D community that has grown over the last 12 years into one of the largest online 3D communities worldwide, with over 160 thousand members. He acquired partners worldwide, and various collaborators trusted him with their ideas as he rewarded them with his consistent state-of-the-art services. Not a moment goes by without him thinking of a beautiful image; thus, he is never concerned with time but only with the design's quality.